Our research into news payment over the last decade shows that in a few richer countries a significant number of people have started to pay for online news. Around four in ten people (40%) in Norway and a fifth (22%) in the United States say they pay for online news, but only around one in ten pay in France (11%) and the UK (8%). But after some growth during the COVID-19 pandemic, subscription numbers seem to have levelled. In our data, the proportion that pay for online news across 20 countries is 17% – a figure that has not changed for the last three years.

Our data also show persistent winner-takes-most patterns. A few big upmarket newspapers – such as the New York Times, Le Monde, and El País – have done best in recent years, having a strong presence in their respective markets. Industry data show a similar picture, with the New York Times reaching 10 million subscribers as of the start of 2024.1 El País reported reaching 300,000 subscribers in 2023,2 while Le Monde reached 500,000.3

A podcast episode on the findings

Spotify | Apple | Transcript

Yet while these headline numbers tell us something, they are only one way of looking at success. This is especially so given the wide range of prices charged and the many different kinds of payments now being used, including donations, low-cost trials, and high-cost premium subscriptions. Headline numbers can obscure the number of people on trials or special offers, or the rate of churn.

In this chapter, we explore the price being paid by digital subscribers across 20 countries and compare this with the official (non-trial) prices advertised by publishers. We also look at how much, if anything, non-subscribers might be willing to pay for online news and the strategies news brands might take to generate more reader revenue.

How many people are paying full price for their news subscription?

For several years of the Digital News Report, we have asked survey respondents across a subset of 20 markets what online news brands they subscribe to. This has given us a picture of the winner-takes-most dynamic playing out across several markets like the US, where the New York Times is a dominant player, and Finland, where Helsingin Sanomat has a formidable subscriber base.

But in our qualitative work we found that many current and former digital news subscribers were not paying full price to access news. This was not surprising, since many news brands offer discounts or trials to new subscribers as a way to encourage people to sign up. But we wanted to try and quantify this in our research.

This year, we asked those who subscribed to different news brands to tell us how much they paid monthly for their main online news subscription, offering them payment bands to choose from (in the UK these were £1 or less, £2–£5, £6–£10, £11–£15, £16–£20, £21–£25, £26–£30, £31–£35, or £36+ per month). We then compared this to the full, non-discounted, non-trial monthly prices advertised for standard digital subscriptions4 to the brands people said they paid for. The next chart shows the proportion of people in each country who pay less than the full asking price for their subscription.

Across all 20 markets, 41% of subscribers say they are not paying the full sticker price, with the majority in Poland (78%) seeming not to pay the full amount, and large proportions in the UK (42%) and US (46%) also not on full-price subscriptions. In markets where the median price5 of a subscription is higher, such as Switzerland, larger proportions of people are paying less than the full asking price. For example, NZZ costs around 29 CHF per month (~US$32), as does Le Temps. But in some other markets where subscriptions are relatively cheaper, such as Spain, Italy, and Portugal, larger proportions are paying the full amount or more. In Spain, a standard El País digital subscription is around €11 (~US$12), and Público in Portugal costs around €7 (~US$7.50).

It is important to note that these estimates are based on survey data and subject to issues of recall. Individual news brands certainly have a picture of how many of their own subscribers are paying full price. But what our data allow is the drawing of a wider picture across the industry, highlighting that there is some commonality across markets. While many people in the US and UK seem not to be paying full price, this also appears to be the case in Australia, Canada, and elsewhere.

With trials, publisher strategies vary across countries

A major reason many people may not be paying the full asking price, as already mentioned, is the fact that many news brands offer discounts and trials as a way to encourage people to sign up. This has been an effective strategy for many news brands looking to build their subscriber base by offering readers a chance to try things out and see what their brand is all about.

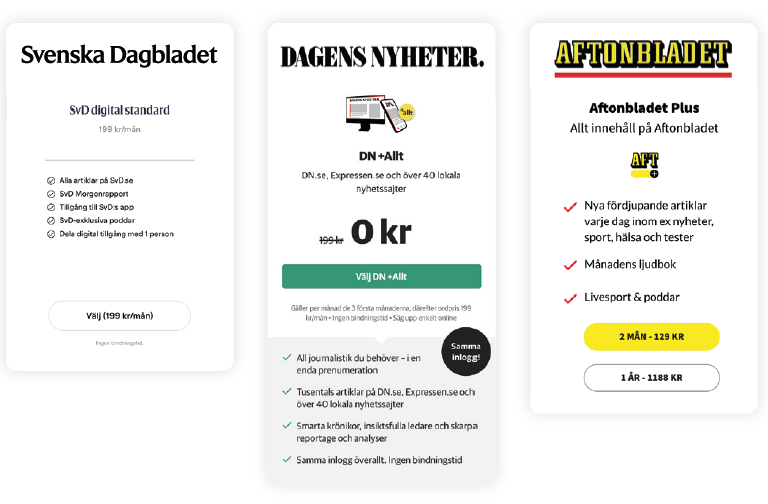

Strategies on this differ by country. Looking at Sweden, where the majority of subscribers (65%) are paying full price for the basic package (or more), shorter trials seem to be the norm: Dagens Nyheter is free for the first three months and Aftonbladet is discounted for the first two months if a monthly subscription is chosen. Svenska Dagbladet didn’t appear to be offering a trial at the time of writing.

Subscription offers in Sweden

Brands in other markets offer trials or discounts for much longer periods of time – sometimes up to a year or more. The US is an example of this, where three of the most prominent news brands – the New York Times, Washington Post, and Wall Street Journal – offer inexpensive one-year trials.

Subscription offers in the United States

Trials may lead to people being won over. As one subscriber (Male, 27) to the Wall Street Journal told us in our report from last year on paying for news (Newman and Robertson 2023): ‘I’m on the 0.99 cent per week promo for the Wall Street Journal. I do think I’ll keep the subscription beyond the promo rate though because the content has won me over.’ But this is not a guarantee. Cheap trials can be effective in getting sign-ups, but keeping people subscribed is another story. The jump from a cheap trial to full price is often too much for many. Trial subscribers may not also continue to full price if they didn’t get into the habit of using their subscription. As one former subscriber (Female, 27) to the Cincinnati Enquirer told us: ‘I really never used the subscription – I only signed up because it was $1.’

It must be kept in mind, however, that our survey data represent a snapshot of what people said they were paying for their news subscriptions at one point in time. We can’t say how many people paying trial prices will potentially move on to paying full prices. But our prior work on this suggests that many may not.

In last year’s Digital News Report, we found that 28% of news subscribers in the US said they had cancelled one or more news subscriptions in the last year. In the UK, the proportion was 17%. After gaining many subscribers during the Trump presidency, it has been reported that the Washington Post has lost hundreds of thousands of subscribers in recent years.6 Based on what our qualitative and quantitative work tells us, it may be the case that many of these were trial subscribers who cancelled early or decided not to continue paying after the trial period ended. Again, raw subscriber numbers do not tell the full story, with such figures potentially masking high rates of underlying churn, where many trial subscribers are lost, only to be replaced with new trial subscribers.

How much would non-subscribers consider paying, if anything?

In addition to asking news subscribers how much they paid, we also asked non-subscribers how much, if anything, they would be willing to pay monthly for an online news subscription. The headline finding is that, across the 20 markets we track, the majority (57%) would not consider paying anything. This rises to around two-thirds in the UK (69%), Germany (68%), and France (67%). A smaller – but still significant – proportion say the same in Finland (43%), Norway (45%), and Ireland (46%). Our data document that much of the public does not believe online news is worth paying for.

There is, however, a group of non-payers who say they would be willing to pay a small amount for a monthly subscription. Keeping in mind that people are answering a hypothetical question (‘what would you pay?’), data suggest there is room for growth in markets that already have high levels of subscription, such as Finland, where half of non-subscribers would consider paying up to €10 per month.

What are the potential approaches to encouraging people to pay?

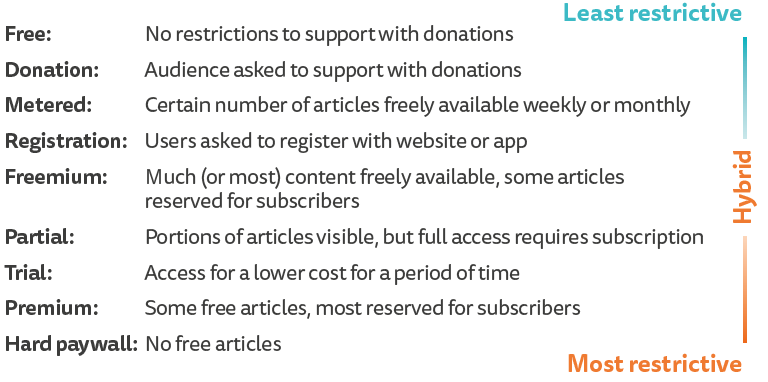

Over the last few years, publishers have developed a number of different models for optimising reader revenue. The chart below, adapted from Raabe (2024), shows a number of the most common approaches to monetising content from ad-based models to different paid approaches.

Types of controlled access to digital news content

Looking across markets, we find brands using a mix of strategies, rather than just a single approach. A common one, despite the increased focus on reader revenue in parts of the news industry, is free access. Many commercial news media continue to make all or most of their news available for free online, and seek to sell advertising around it (e.g., CNN, Sky News, RTL in Germany). In markets where they exist, many non-profit news media and public service media also provide online news for free (e.g., BBC).

At the other end of the continuum, some upmarket publications such as The Australian use a relatively hard paywall, but others such as the New York Times, the Irish Independent, and de Volkskrant (Netherlands) use a hybrid registration/premium approach, where readers can access some general news stories for free if they register, but where the rest of the content is for subscribers only. With the decline of third-party cookies, there has been a push for registration across the industry, a strategy which gives news brands the opportunity to communicate directly with readers via email and to better track logged-in audience behaviour for targeted communications or advertising. The goal here is to take those who register on the journey towards ongoing subscription.

The following chart shows the approaches taken by some of the largest subscription brands in their respective markets, including Gazeta Wyborcza in Poland (articles are partially available to non-subscribers) and Le Monde (France), Expresso (Portugal), and El País (Spain), which operate a partial/premium approach, where some articles are free to access, while others have the first paragraph available before being cut off by a paywall. Finally, the freemium approach is adopted by many tabloids with large amounts of online traffic. This strategy, used by Bild (Germany), VG (Norway), and Het Laatste Nieuws (Belgium), allows them to offer much cheaper deals to subscribers, with these lower prices being offset by advertising revenue.

It goes without saying, however, that there is no one-size-fits-all approach to encouraging people to pay for news, and what works will vary from market to market, brand to brand. The size of these mentioned brands doesn’t mean their approaches are necessarily the best way forward, especially for small or mid-sized publications.

Major news brands and their monetisation strategies

The future of paying for news

The news business is in a difficult spot and more publishers are looking to direct reader payment as a primary strategy to supplement advertising revenue. But in all countries we find that only a minority (17%) are willing to pay and, as we have shown, the rest are not prepared to pay very much at all. The majority (57%) would not consider paying anything.

Our findings, moreover, suggest that the news industry has, in many countries, already got most of the people interested enough to pay for current offers and at current prices, with rates of payment stagnating. Cheap trials have been one way for news brands to increase headline subscriber numbers, but it’s not a guarantee that those on trial will continue to pay long term. We find that the tendency to offer discounts has resulted in a significant proportion of subscribers (41%) not paying full price.

Besides this group of payers, in most markets there is a group willing to pay something if the price and product are right, but it’s only ever a small amount – and perhaps not enough to be attractive for publishers. Strategies to encourage those on the fence have included longer trials, bundled multi-brand offers, non-news features like games and recipes, or different packages of content like cut-down curated offers or replica e-editions at different price-points.

Whatever the monetisation approach adopted by news brands, however, it is incumbent on news organisations to showcase their value to audiences, demonstrating why they are worth paying for. The industry has many different techniques to encourage people to pay, but they will only do so if it enriches their lives. A sizeable minority has been convinced to pay significant sums for current online news offers, but most people are not willing to pay for what is currently on offer. And among those not currently paying – who may be convinced to do so – are many who do not look open to existing standard offers and price points.

Footnotes

1 https://www.nytimes.com/2024/02/07/business/media/new-york-times-q4-earnings.html

2 https://www.prisa.com/en/noticias/noticias-1/el-pais-supera-los-300.000-suscriptores-en-solo-tres-anos

3 https://www.lemonde.fr/en/about-us/article/2023/09/24/two-major-milestones-for-le-monde-s-independence_6139073_115.html

4 Brands often offer multiple types of subscriptions. We looked at standard digital subscriptions that give access to news content without the additional benefits that premium or standard+ subscription packages offer.

5 The median price balances between high-cost premium titles and lower-cost ‘freemium’ offers, which can skew averages.

6 https://www.thewrap.com/washington-post-lost-subscribers-biden-term/